owner draw quickbooks s-corp

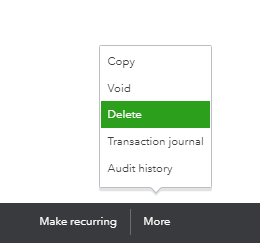

I have a new Client that is a 2 person C Corp 1120 with subcontractors that will all get 1099-Misc. Once done click Save and.

Solved S Corp Officer Compensation How To Enter Owner Eq

An owners draw gives you more flexibility than a salary because you can pay yourself practically whenever youd like.

. If you are a small business owner or running a proprietorship firm then it is essential for you to know how to record S-Corp distribution in QuickBooks easily. The funds are transferred from the business account to the owners personal bank. Draws can happen at regular intervals or when needed.

They 2 owners did not start payroll until September. This is important to note since if your basis is. A is also Ss president and only employee.

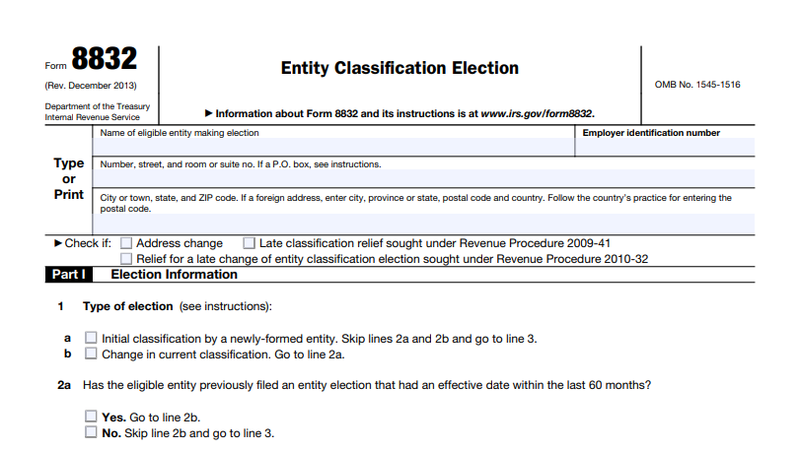

Owners of some LLCs partnerships and sole proprietorships can take an owners draw. Any shareholder of an S corporation who works for the entity is considered an. Select New in the Chart of.

But a shareholder distribution is not meant to replace the. Ad Manage More Of Your Business All From One Place With Best-In-Class Apps. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner.

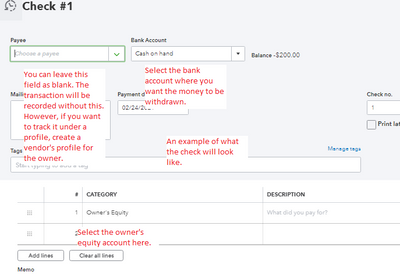

Select the Gear icon at the top then Chart of Accounts. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Add other details of the check such as reference number memo etc.

S generates 100000 of taxable income in 2011 before. However corporation owners can. Under Category select the Owners Equity account then enter the amount.

How do I record an owners salary in QuickBooks. Set up and pay a draw for the owner. Draws can happen at regular.

Create a business Other Liability account. Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws. Youre allowed to withdraw from your share of the businesss value through an owners draw.

Owners draw in an S corp Since an S corp is structured as a corporation there is no owners draw only shareholder distributions. A owns 100 of the stock of S Corp an S corporation. Pros of an owners draw Owners draws are flexible.

Create Simplify And Automate Workflows When You Integrate Your App Data. Example 1. Make sure you use owners contributionsdraws.

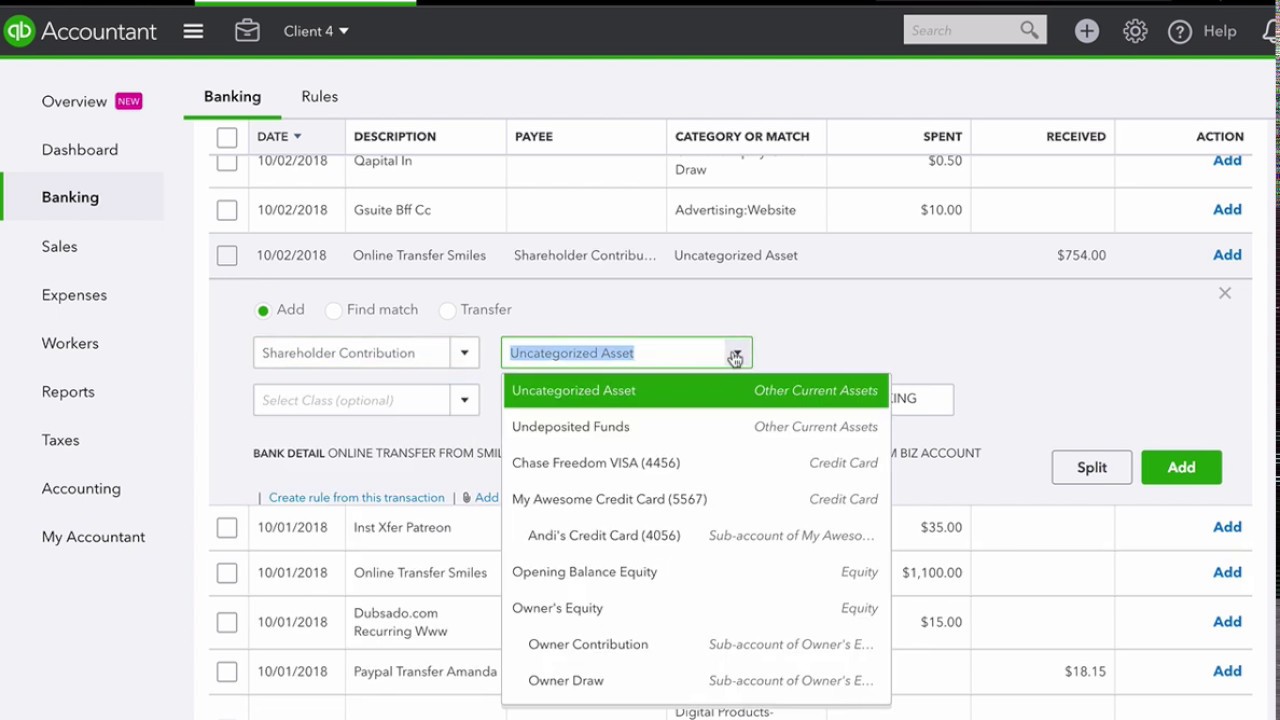

This article describes how to. The business owner takes funds out of the business for personal use. I named it Shareholder Draws to be consistent with what I had in QBs.

When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the. I need help please. A members draw also known as an owners draw or a partners draw is a QuickBooks account that records the amount taken out of a company by one of its owners.

S corporations and C corporations cannot take draws. An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. Create Simplify And Automate Workflows When You Integrate Your App Data.

Reduce your basis ownership interest in the company because they are equity transactions on your balance sheet. As a business owner at least a part of your business bank account belongs to you. The owners of S corporations have options to take money out of the business.

I know that using a Liability account isnt technically correct but the basic. Ad Manage More Of Your Business All From One Place With Best-In-Class Apps. What is drawings on QuickBooks.

An owners draw is a separate equity account thats used to pay the owner of a business.

Solved S Corp Officer Compensation How To Enter Owner Eq

Reshebnik Rabochej Tetradi Po Informatike 8 Klass Bosova Richard Pryor Pryor Ego

What S The Difference Between A W 2 Vs 1099 Gusto First Day Of Work Finance Tax Time

Benefits Of Owning An S Corp Taking Distributions

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

S Corp Vs C Corp Which Is Right For Your Small Business The Blueprint

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

Paystub Samples Professional Looking Templates Free Preview Payroll Template Paycheck Payroll Checks

Quickbooks Chart Of Accounts For Contractors Small Corporation S Corp Desktop Bundle Fast Easy Accounting Store

S Corp Advantages Disadvantages The Complete Guide Amy Northard Cpa The Accountant For Creatives S Corporation Business Tax Small Business Tax

How Much To Pay Yourself As An S Corporation Owner Youtube

Taxation In An S Corporation Distributions Vs Owner S Compensation Youtube

How To Categorize Shareholder Distributions And Contributions In Qbo Youtube

Solved S Corp Officer Compensation How To Enter Owner Eq

6 Essential Words To Understanding Your Business Finances Small Business Bookkeeping Small Business Finance Business Finance